August 28, 2025

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

The financial markets thrive on speed. Every millisecond counts, and the difference between success and loss often comes down to how fast trades are executed. This is where high-frequency trading (HFT) has redefined how firms operate. What was once impossible with traditional trading systems is now achievable through automation and advanced computing.

High-frequency trading software development has become a core priority for hedge funds, brokers, and specialized HFT firms. With the proper infrastructure, these organizations can process thousands of trades in fractions of a second, capturing opportunities invisible to the human eye.

Why does this matter? Because the market never waits. HFT software brings speed, efficiency, and precision to the financial ecosystem. Hedge funds, proprietary trading desks, and brokers all rely on HFT trading software to maintain their competitive edge.

At its simplest, high-frequency trading is a form of algorithmic trading that executes a massive number of trades in extremely short timeframes. Using powerful systems and real-time data analysis, it exploits small price fluctuations that are often lost in manual or slower digital trading processes.

The core characteristics of HFT include:

In practice, HFT companies hire specialized HFT developers and engineers who focus on building platforms capable of handling this demand. A skilled high-frequency trading software developer understands both finance and technology, bridging the gap between quantitative models and high-speed execution.

Building HFT trading software is a highly specialized task that demands accuracy at every stage. Unlike traditional trading platforms, an HFT software solution must achieve strict performance benchmarks where even microseconds matter. The development lifecycle typically unfolds in the following stages:

The process begins with clarity. Firms define their trading objectives, identify target markets, and outline financial models. Requirements such as execution speed, real-time data handling, and risk management frameworks are mapped out at this stage.

Not every developer is equipped for this domain. Successful projects require HFT developers who combine expertise in finance, quantitative analysis, and high-performance computing. The collaboration between quants and engineers ensures that both strategy and technology align.

The foundation of HFT development lies in architecture. Low-latency networks, co-location servers, and scalable storage systems are carefully planned. Each component must be optimized to minimize delay while supporting future growth.

At the heart of any HFT software solution are the algorithms. These models are built to analyze patterns, predict market moves, and execute trades automatically. Extensive backtesting with historical data refines these strategies before live use.

Performance tuning comes next. Systems are fine-tuned to achieve microsecond-level execution consistently. Stress testing under simulated conditions ensures algorithms can perform under real-world market pressure.

Once live, the platform is integrated into production environments. Deployment is only the beginning; continuous monitoring, updates, and strategy refinements keep the software competitive in fast-changing markets.

For many organizations, partnering with an experienced trading software development company accelerates this process. By relying on specialists, firms reduce development risks and ensure the final HFT software meets the highest standards of reliability, speed, and security.

.webp)

A powerful HFT software solution is defined not only by speed but also by reliability, adaptability, and security. To compete effectively, firms need systems that can withstand the pressure of high volumes and still deliver precise execution. The most critical features include:

Latency is the heartbeat of high-frequency trading software. The ability to reduce execution delays to microseconds gives firms a competitive edge. This is achieved through optimized code, advanced networking, and hardware acceleration, ensuring trades are placed ahead of the competition.

Modern HFT trading software integrates complex statistical models, arbitrage strategies, and predictive analytics. These algorithms continuously adapt to market conditions and ensure the platform reacts instantly to even the smallest fluctuations.

An effective HFT software solution provides direct integration with global stock, futures, options, and crypto exchanges. This broad connectivity increases liquidity access and enables firms to capitalize on cross-market opportunities.

Processing large volumes of market data without performance degradation is essential. By analyzing and responding to live feeds in real time, the system ensures execution decisions are based on the most accurate, up-to-the-moment information.

Risk control is as important as speed. HFT development incorporates advanced monitoring tools that track exposure in real time, enforce position limits, and apply safeguards to minimize potential losses.

Flexibility matters. Custom APIs allow firms to integrate proprietary trading models, connect with compliance systems, and enhance back-office operations. This makes the platform adaptable to unique strategies and business needs.

Together, these features form the backbone of HFT software development, ensuring that firms gain the speed advantage while maintaining security, accuracy, and long-term sustainability.

.webp)

Why do firms continue to allocate significant resources to HFT development, despite its technical complexity and infrastructure demands? The answer lies in the tangible advantages that high-frequency trading software delivers to those operating in competitive markets.

Automated systems process information and execute trades far faster than human traders ever could. By relying on HFT trading software, firms achieve precision at scale, free from emotional decision-making that often undermines manual trading.

The constant flow of buy and sell orders generated by HFT companies boosts liquidity across markets. This increased activity reduces spreads and creates a more efficient environment for all participants, from institutional investors to retail traders.

The margins on each transaction may be small, but multiplied across thousands of trades per second, they create significant profit opportunities. This ability to monetize micro-price fluctuations is the foundation of why HFT firms remain profitable even in volatile markets.

Unlike off-the-shelf platforms, customized HFT software solutions allow firms to align systems with their specific strategies. As market structures shift, these platforms can expand in functionality, ensuring firms stay competitive without replacing their entire infrastructure.

Ultimately, the strength of HFT software development lies not only in speed but also in reliability and consistency. For firms that must operate in environments where milliseconds determine outcomes, dependable execution becomes the defining factor between success and missed opportunity.

Behind every HFT software solution is a strong technology stack. Common components include:

C++ remains the industry standard for low-latency systems. Python and Java are often used for data analysis and auxiliary processes.

Network optimization reduces execution time. Some firms use FPGA (Field-Programmable Gate Array) hardware for near-instant data handling.

On-premises systems provide maximum control and minimal latency. Cloud platforms help scale storage and analytics.

Predictive models identify patterns across markets. Many HFT companies already incorporate ML to refine execution strategies.

These technologies define how competitive an HFT trading software system can be.

Developing HFT software is not without complications. Firms face several challenges:

Even a few microseconds of delay can result in missed opportunities. Achieving this requires significant investment.

With growing regulation, HFT firms must ensure compliance while protecting systems from cyber threats.

The cost of servers, co-location, and continuous upgrades can be substantial.

Algorithms must balance profitability, risk management, and compliance. This requires close collaboration between quants and developers.

These challenges highlight why HFT companies rely on expert HFT developers rather than generic trading solutions.

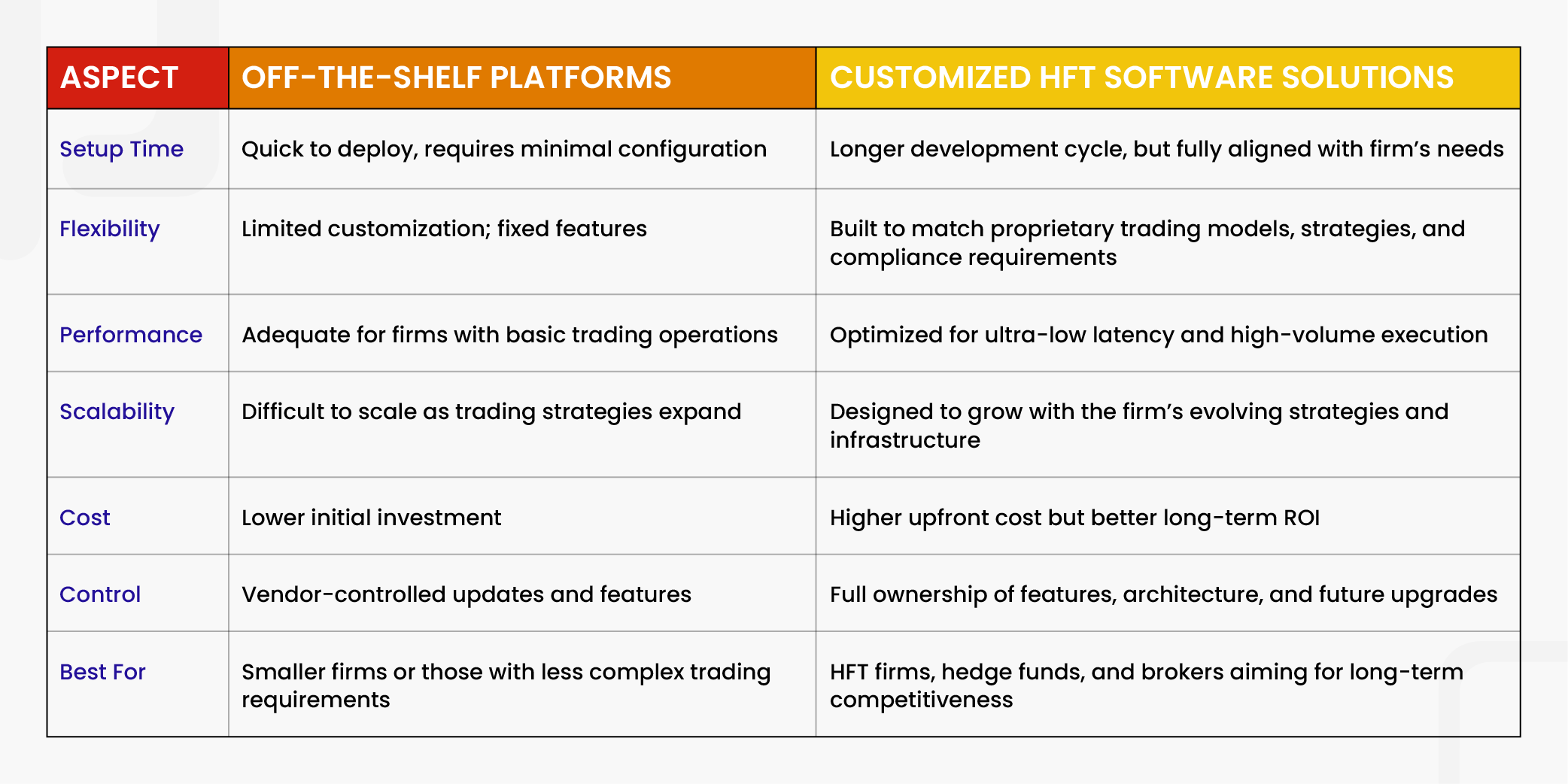

When firms consider HFT trading software, they usually face a key decision: whether to adopt an off-the-shelf platform or invest in a customized solution. Each approach has distinct advantages and limitations.

The cost of HFT software development varies based on multiple factors:

In general, development costs range from hundreds of thousands to several million dollars, depending on the scale. While expensive, the potential returns often justify the investment for serious HFT firms.

Choosing the right partner for HFT software development is one of the most important decisions a firm will make. The right company does more than write code; it becomes a strategic partner that ensures your trading platform performs under the most challenging market conditions. When evaluating a potential partner, consider the following:

The firm should have demonstrable experience in building ultra-fast, reliable trading platforms. A history of delivering solutions with microsecond-level performance is a strong indicator of capability.

Look for real-world case studies or client references. A company that has already served established HFT firms understands the demands of the industry and the expectations of regulators.

The team should include seasoned high-frequency trading software developers, network engineers, and quantitative specialists. This mix of skills ensures that financial strategies are translated into robust technical implementations.

From strategy definition and architecture planning to deployment and ongoing support, a strong partner can manage the entire lifecycle of HFT development. This reduces coordination risks and ensures accountability.

The rise of high-frequency trading has shown how critical speed, precision, and reliability are in today’s financial markets. Firms that invest in high-frequency trading software development gain a decisive advantage by accessing real-time data, executing trades in microseconds, and managing risk more effectively. From advanced algorithms to real-time analytics, a robust HFT software solution provides the foundation that HFT firms and hedge funds depend on to stay ahead.

At Webmob Software Solutions, we take pride in being recognized as a top trading software development company. Our expertise spans HFT development, algorithm design, and infrastructure planning, enabling us to deliver customized HFT software solutions for clients worldwide. Whether you need HFT developers, system optimization, or a complete platform built from the ground up, our team ensures your trading operations meet the highest standards. By working with an experienced high-frequency trading software developer, you position your firm to compete with leading HFT companies in one of the most demanding industries.

Ready to take your trading strategies to the next level? Connect with us today and let’s discuss how our HFT trading software expertise can help your business achieve its goals.

High-frequency trading software development involves building platforms that automate trading at ultra-high speeds using advanced algorithms, low-latency networks, and optimized infrastructure. These systems allow HFT firms to analyze market data instantly, identify opportunities, and execute trades faster than traditional methods.

Unlike standard retail or institutional platforms, HFT trading software is designed for microsecond execution, high-volume transactions, and complex algorithmic strategies. Regular software prioritizes accessibility and user experience, while HFT software development focuses on speed, scalability, and precision for competitive financial environments.

The timeline for developing HFT software solutions varies based on complexity, infrastructure needs, and strategy requirements. On average, development takes several months to more than a year, particularly when firms opt for customized HFT software solutions tailored to unique trading models and compliance standards.

Yes. Skilled HFT developers can create proprietary algorithms that align with a firm’s specific trading models, risk management policies, and market strategies. Custom algorithm design is a core element of HFT software development, enabling firms to gain an edge over competitors.

Yes. As digital asset markets expand, many HFT companies apply high-frequency strategies to cryptocurrency exchanges. Our HFT software solutions support crypto trading with the same low-latency execution, algorithmic flexibility, and risk management capabilities used in traditional equity, futures, and options markets.

Yes. AI and ML play a growing role in HFT development by enhancing prediction models, detecting anomalies, and refining execution strategies. By integrating intelligent algorithms, HFT trading software helps firms increase accuracy, reduce risk, and adapt to fast-changing markets.

Security is vital in high-frequency trading software development. Systems are safeguarded with encryption, secure APIs, and multi-layered access controls. Experienced high-frequency trading software developers also integrate compliance checks and monitoring tools, ensuring the platform protects sensitive data while meeting industry regulations.

Copyright © 2026 Webmob Software Solutions