December 30, 2025

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Building a real estate tokenization platform in 2026 requires careful financial planning and strategic decision-making. The cost to build real estate tokenization platform varies significantly based on complexity, compliance requirements, and chosen development approach. From basic MVPs starting at $15,000 to enterprise solutions exceeding $300,000, understanding these investments is critical for businesses entering the fractional property ownership market.

Real estate tokenization platform development transforms physical properties into blockchain-based digital assets, enabling fractional ownership and 24/7 trading capabilities. The global tokenization market, valued between $2.5-$3.5 billion in 2025, projects explosive growth to $16-18 trillion by 2030, representing a compound annual growth rate of 19.8%. This growth stems from institutional adoption and regulatory clarity through frameworks like EU MiCA and U.S. SEC guidelines.

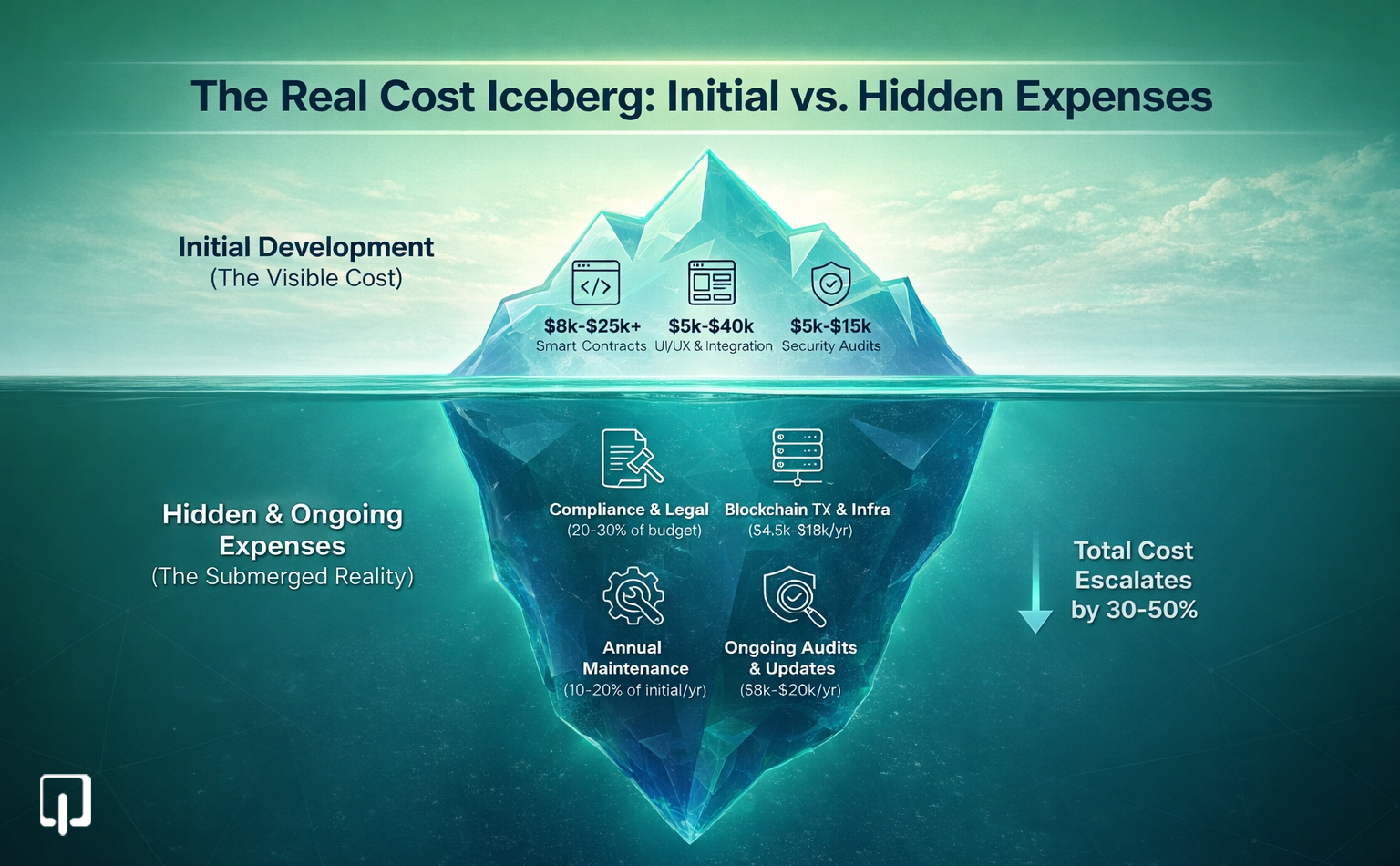

However, the real estate tokenization platform pricing model extends beyond initial development costs. Hidden expenses, compliance requirements, and ongoing maintenance can escalate budgets by 30-50%, making transparent cost breakdowns essential for informed decision-making.

Smart contracts form the foundation of any tokenization platform, automating token issuance, ownership transfers, and profit distribution without intermediaries. The cost to build real estate tokenization platform smart contracts ranges from $8,000-$25,000 for basic ERC-20 implementations to $10,000-$15,000 for advanced features including lockup periods and automated dividend distributions.

Smart contract audit fees 2026 remain non-negotiable given historical blockchain exploits totaling over $3 billion in losses. Professional security audits prevent vulnerabilities like reentrancy attacks, protecting investor assets and platform reputation.

Multi-chain deployment to networks like Polygon and Binance Smart Chain adds $10,000-$20,000 but reduces transaction costs by 80-90% compared to Ethereum mainnet, significantly improving user experience and operational efficiency.

Real estate tokenization platform development must navigate complex regulatory environments where tokens typically classify as securities. Compliance costs represent 20-30% of total budgets, ranging from $5,000 for basic MVP implementations to $40,000+ for enterprise solutions operating across multiple jurisdictions.

The SEC Howey Test in the United States, MiCA regulations in Europe, and evolving frameworks in Singapore and Hong Kong each impose specific requirements. Platforms targeting global investors face exponentially higher compliance expenses compared to single-region operations.

Non-compliance risks platform shutdowns and complete investment loss, making legal infrastructure a critical priority rather than optional expense. White label real estate tokenization cost often includes pre-built compliance modules, reducing both expense and time to market.

Real estate tokenization platform pricing model must account for comprehensive frontend and backend development. Investor dashboards, administrative panels, and wallet integrations demand intuitive design, with costs ranging from $5,000-$10,000 for template-based solutions to $20,000-$40,000 for custom enterprise interfaces.

Custom STO platform development price escalates when incorporating advanced features like AI-driven property valuations, automated yield calculations, or DeFi protocol integrations. These sophisticated capabilities differentiate enterprise platforms but require specialized development expertise.

Security represents 10-15% of total real estate tokenization platform development budgets. Multi-factor authentication, multi-party computation key management, and comprehensive penetration testing cost between $3,000-$5,000 for MVPs and $15,000-$30,000 for enterprise implementations.

The 2022 Ronin Network breach, resulting in $625 million losses, underscores the catastrophic consequences of inadequate security measures. Professional security audits, though expensive, provide essential investor confidence and regulatory compliance.

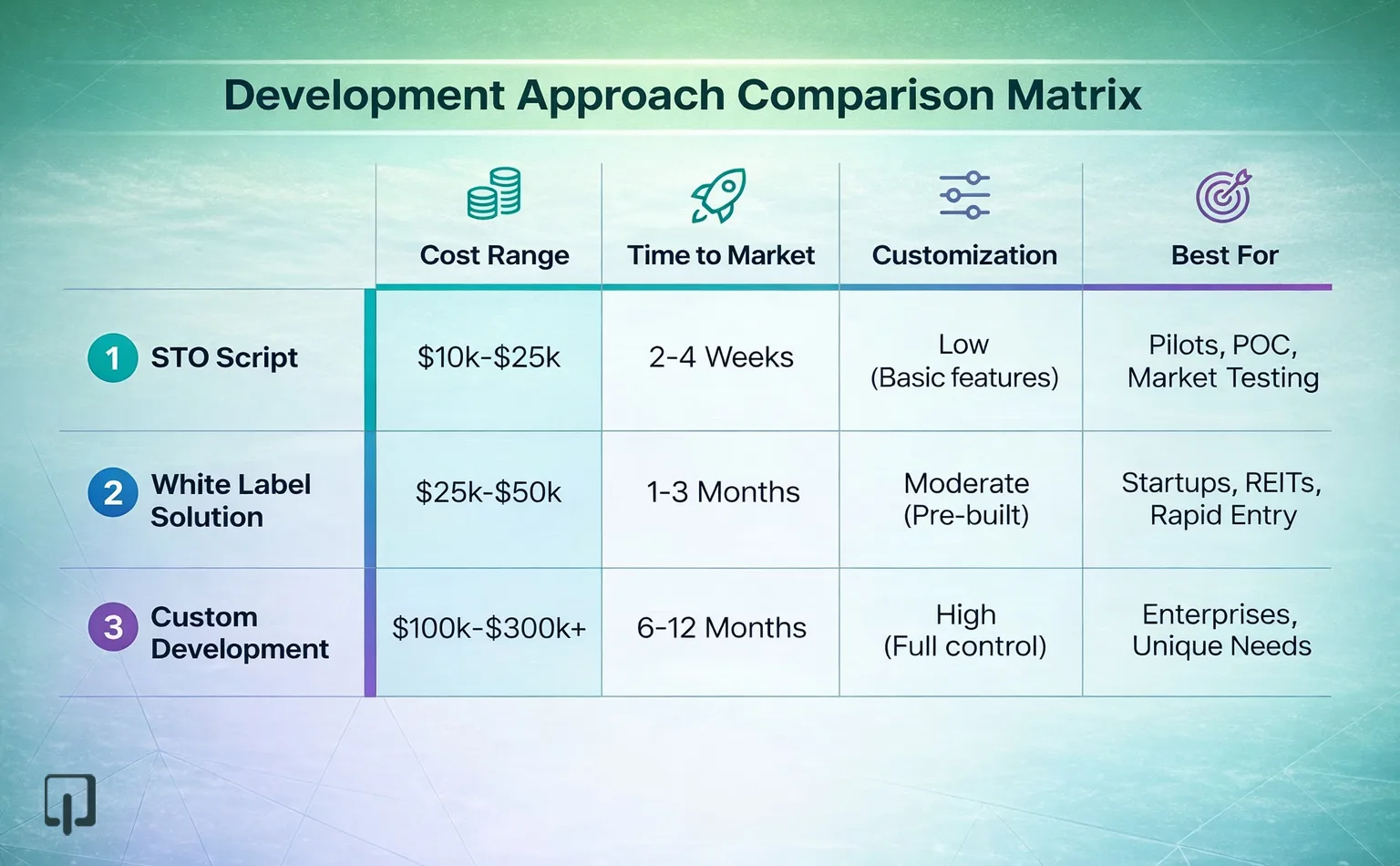

Custom STO platform development price provides complete flexibility and intellectual property ownership but requires investments of $100,000-$300,000+ with 6-12 month development timelines. This approach suits enterprises requiring proprietary features, unique DeFi integrations, or specialized compliance workflows.

White label real estate tokenization cost ranges from $25,000-$50,000 with 1-3 month deployment timelines, offering pre-built, compliance-ready platforms. This approach dominates 2026 market projections, capturing approximately 60% market share through balance of affordability and functionality.

RWA tokenization software company providers deliver tested infrastructure, reducing development risk and accelerating revenue generation. While branding customization has limitations, core functionality meets most business requirements without reinventing established solutions.

Tokenization software development quote for STO scripts starts at $10,000-$25,000, providing the most economical entry point with deployment possible within weeks. These solutions suit pilot projects, proof-of-concept demonstrations, or startups testing market viability.

However, basic feature sets, limited customization options, and potential scalability constraints make STO scripts better suited for initial market validation rather than long-term enterprise operations.

Maintenance cost for blockchain real estate platforms includes ongoing blockchain transaction fees varying dramatically by network. Ethereum mainnet gas fees range from $50-$200 per transaction, while Layer 2 solutions like Polygon reduce costs to $0.01-$1 per transaction.

Platforms processing significant transaction volumes must carefully evaluate blockchain selection based on fee structures, security requirements, and target user demographics.

Hidden costs of tokenization software include annual maintenance representing 10-20% of initial development investment. Smart contract upgrades addressing security vulnerabilities, regulatory changes, or feature enhancements require recurring development resources.

Regulatory shifts, such as MiCA Phase 2 implementation in Europe, may demand $10,000-$20,000 platform reworks to maintain compliance and market access.

The true cost to build real estate tokenization platform extends 1.5-2x the initial development budget over three years when accounting for maintenance, compliance updates, infrastructure, and security requirements.

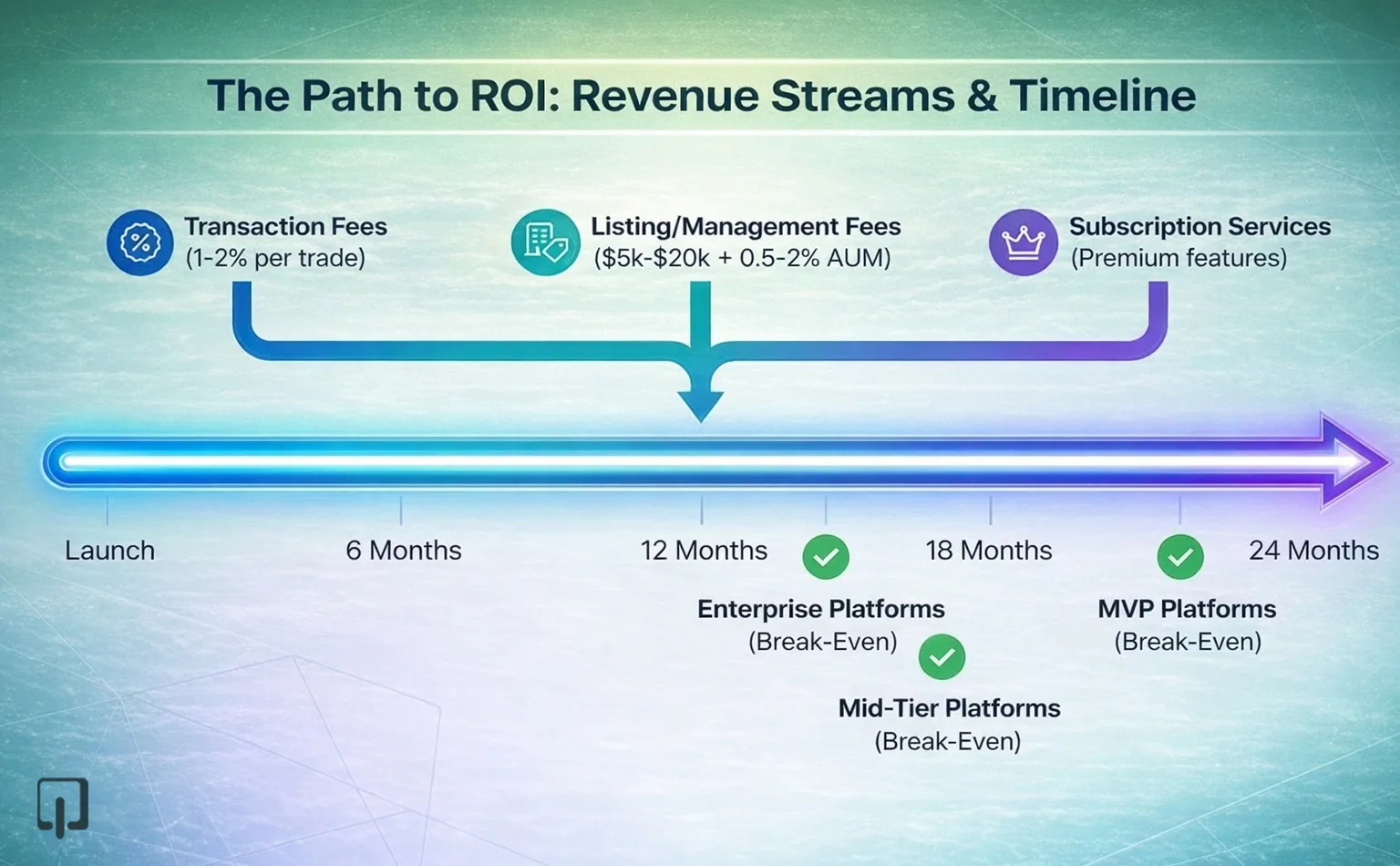

Platforms typically charge 1-2% transaction fees on all token trades, creating scalable revenue directly proportional to platform activity. A platform managing $1 million in assets under management (AUM) generates $10,000-$20,000 annually through transaction fees alone.

Listing fees ranging from $5,000-$20,000 per tokenized property provide upfront revenue, while ongoing asset management fees of 0.5-2% of AUM create recurring income streams stabilizing cash flow.

Enterprise features, advanced analytics, white-label licensing, and priority support can be monetized through tiered subscription models, diversifying revenue beyond transaction-dependent income.

The $16-18 trillion total addressable market by 2030 provides substantial growth opportunities for well-positioned platforms capturing even modest market share.

Starting with cost-efficient blockchains like Polygon for MVP launches caps initial investments around $20,000 while maintaining scalability for future Ethereum mainnet migration. Layer 2 solutions like Arbitrum and Optimism compress costs by 15-20% in 2026 compared to traditional approaches.

Outsourcing to development markets in India or Eastern Europe reduces costs by 30-50% compared to North American or Western European rates without compromising quality. However, vendor selection requires careful evaluation of blockchain expertise and regulatory knowledge.

Beginning with white label real estate tokenization cost models minimizes upfront investment and accelerates market validation. Successful platforms can reinvest early revenue into custom feature development, balancing cost control with competitive differentiation.

Collaborating with established RWA tokenization software company providers, legal firms specializing in securities regulation, and institutional real estate partners reduces individual development burdens while accelerating credibility and market access.

A: Basic MVP development starts at $15,000-$25,000 for single-property pilots targeting accredited investors. This includes essential smart contracts, basic compliance, and fundamental user interfaces. However, total ownership costs including maintenance and compliance reach $25,000-$40,000 over the first year.

A: White label solutions cost $25,000-$50,000 with 1-3 month deployment versus custom development at $100,000-$300,000+ requiring 6-12 months. White label platforms provide 40-60% cost savings and faster market entry but with reduced customization flexibility.

A: Smart contract audit fees ($5,000-$15,000), ongoing maintenance (10-20% of initial build annually), regulatory compliance updates ($10,000-$20,000), and blockchain transaction fees represent the largest hidden expenses, potentially adding 30-50% to initial budget projections.

A: Platforms typically reach break-even within 12-18 months at scale, processing 5-10 tokenized properties with moderate transaction volumes. Revenue from 1-2% transaction fees, listing charges, and management fees enables cost recovery, though timeline varies significantly based on market conditions and user acquisition success.

A: Professional smart contract audits range from $5,000-$7,000 for basic implementations to $10,000-$15,000 for complex multi-feature contracts. Multi-chain platforms require additional $5,000-$8,000 per blockchain. Annual security reviews add $5,000-$12,000 to ongoing budgets.

The cost to build real estate tokenization platform in 2026 spans a wide spectrum from $15,000 MVP validations to $300,000+ enterprise deployments, with success depending on strategic alignment between budget, timeline, and business objectives. Understanding the complete investment picture, including smart contract development, compliance infrastructure, security requirements, and hidden ongoing expenses, enables informed decision-making in this rapidly expanding $16-18 trillion market opportunity.

Real estate tokenization platform development represents more than technical implementation. It requires balancing regulatory compliance, security imperatives, and user experience against financial constraints and competitive pressure. White label solutions offer compelling value propositions for startups and REITs seeking rapid market entry, while custom development serves enterprises requiring proprietary capabilities and maximum control.

The maintenance cost for blockchain real estate platforms, often underestimated at 10-20% of initial investment annually, demands careful financial planning extending beyond launch. However, platforms successfully navigating these challenges position themselves at the forefront of property democratization, fractional ownership expansion, and global real estate market transformation. Strategic technology selection, phased deployment approaches, and partnership ecosystems maximize ROI potential while managing risk in this dynamic regulatory environment.

Copyright © 2026 Webmob Software Solutions