September 5, 2025

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

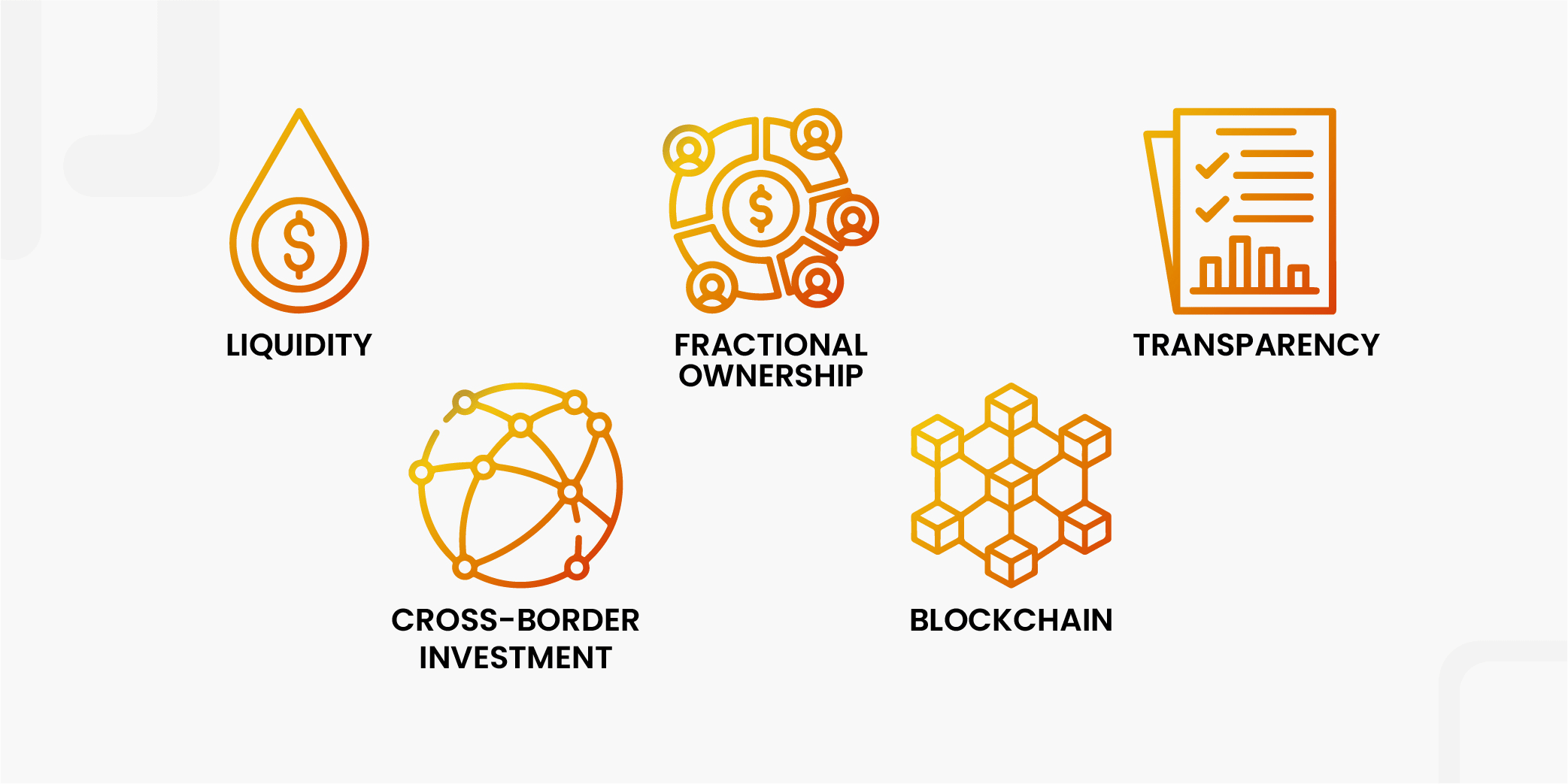

Real estate has always been a cornerstone of wealth creation. Yet, investing in prime properties often requires a significant amount of capital, creating barriers for many investors. That’s where tokenization steps in. By converting physical real estate assets into digital tokens, ownership becomes more accessible, liquid, and transparent.

In Saudi Arabia, the timing could not be more significant. With Vision 2030 placing real estate and technology at the center of economic diversification, Real Estate Tokenization in Saudi Arabia is gaining traction. The push for digital transformation has created demand for innovative investment models that bridge traditional real estate with blockchain technology.

For businesses, institutions, and regulators, building a custom real estate tokenization platform in Saudi Arabia is not just a technological project. It’s a strategic step that aligns with national goals while catering to both local and international investors.

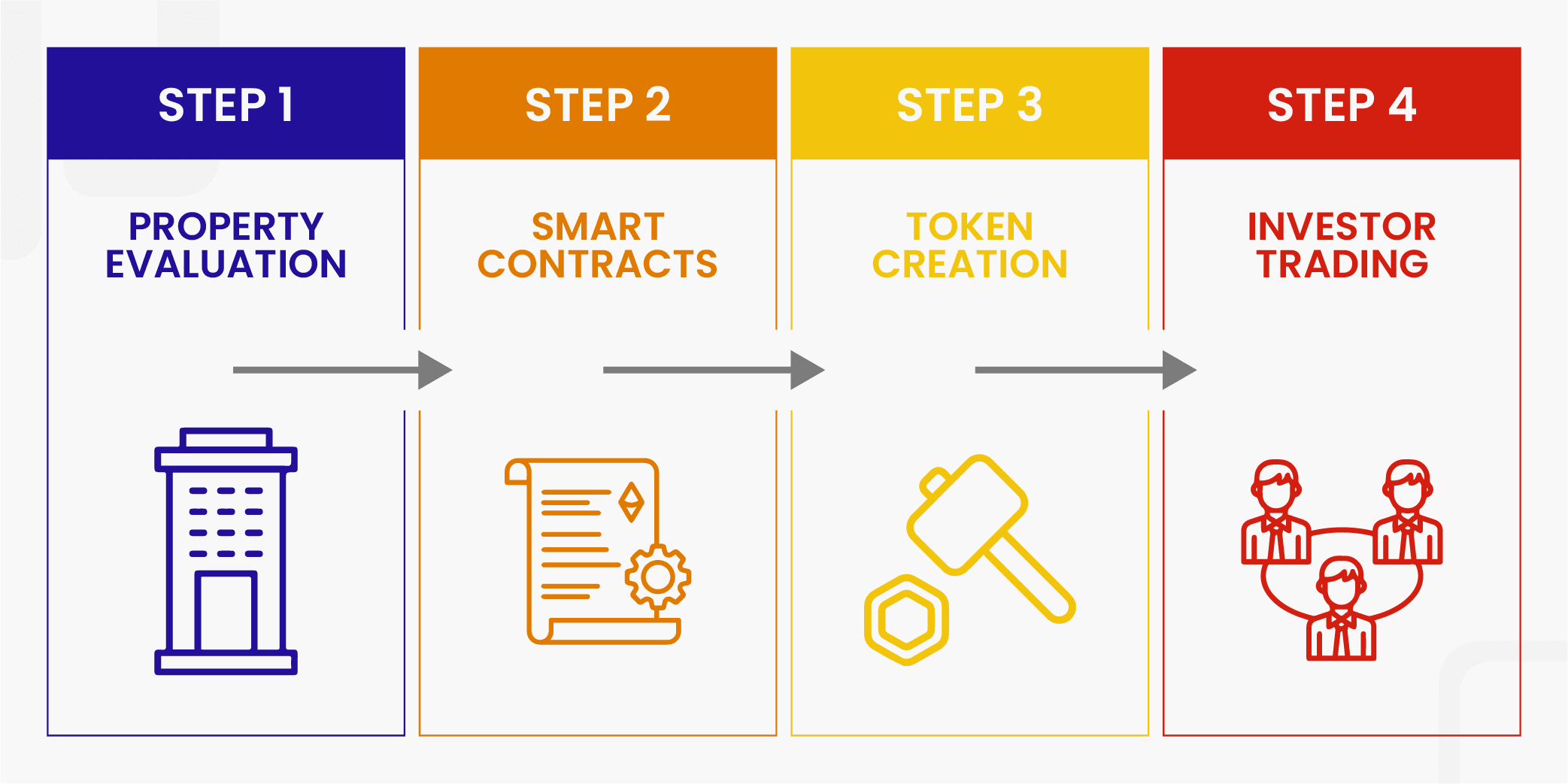

So, what exactly is real estate tokenization? At its core, it’s the process of representing property ownership digitally through blockchain-based tokens. Each token reflects a share of the asset, whether that’s a commercial building in Riyadh, a residential development in Jeddah, or a hospitality project in NEOM.

Globally, tokenization has already gained traction in the US, Europe, and parts of Asia. However, Saudi Arabia presents unique opportunities. With its real estate market valued in the trillions and a government eager to adopt digital solutions, the kingdom is well-positioned to become a regional hub for the development of real estate tokenization platforms.

Why is there so much attention on this concept right now?

This convergence of technology, regulation, and demand sets the stage for meaningful growth in real estate tokenization platform development in Saudi Arabia.

Developing a tokenization platform isn’t just about writing smart contracts. It requires a robust technical foundation designed for compliance, efficiency, and security. Let’s break down the essential components.

Building such a platform requires not only technical expertise but also a deep understanding of local compliance requirements. Without both, adoption will remain limited.

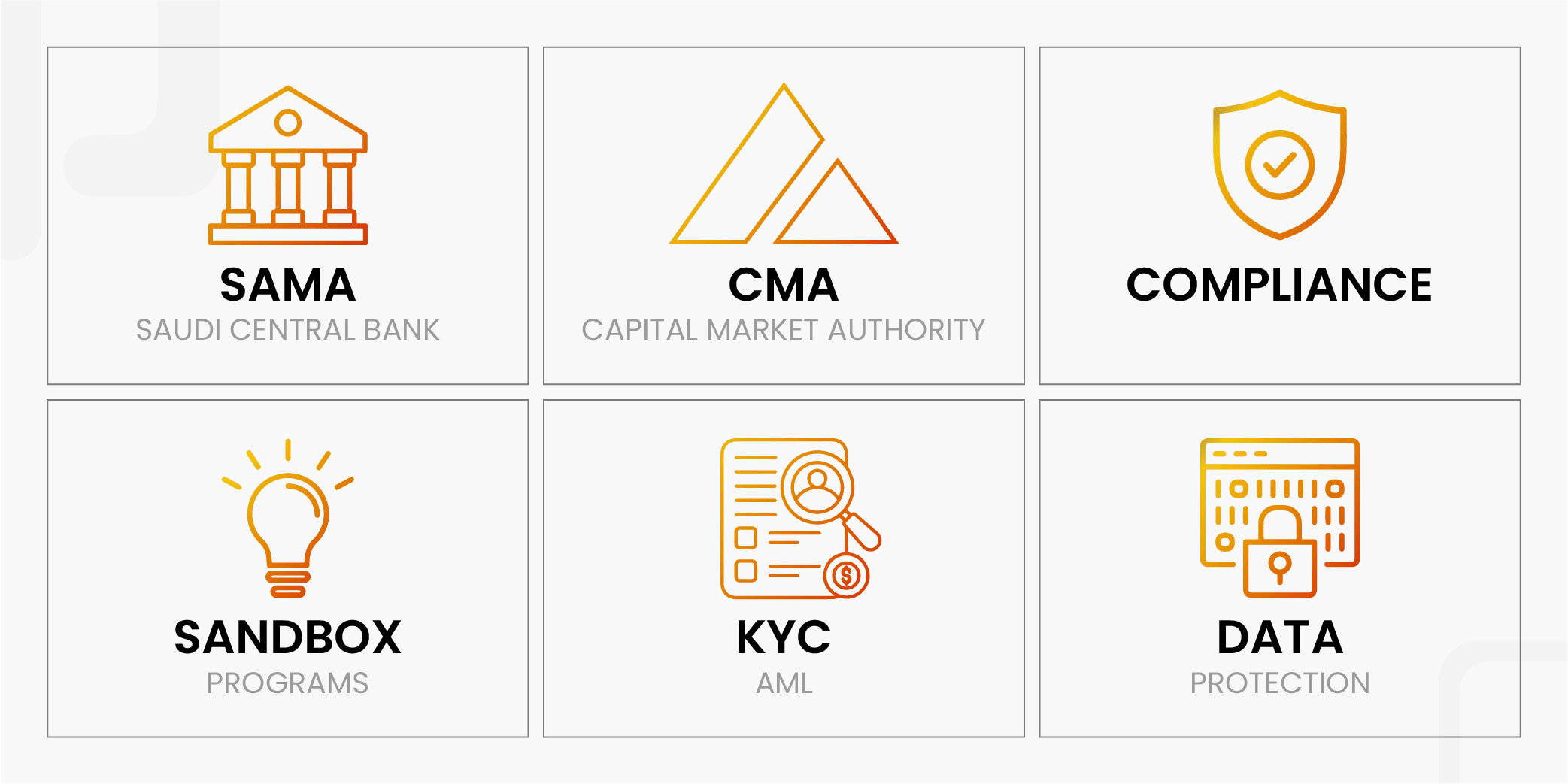

No tokenization platform can succeed without strong regulatory foundations. Saudi regulators are cautious yet forward-looking.

Saudi Arabia has not yet fully formalized its regulations for tokenized securities. However, sandbox initiatives provide space for pilot projects. The focus remains on investor protection, financial stability, and alignment with Vision 2030.

In short, success depends on creating platforms that merge technology with compliance.

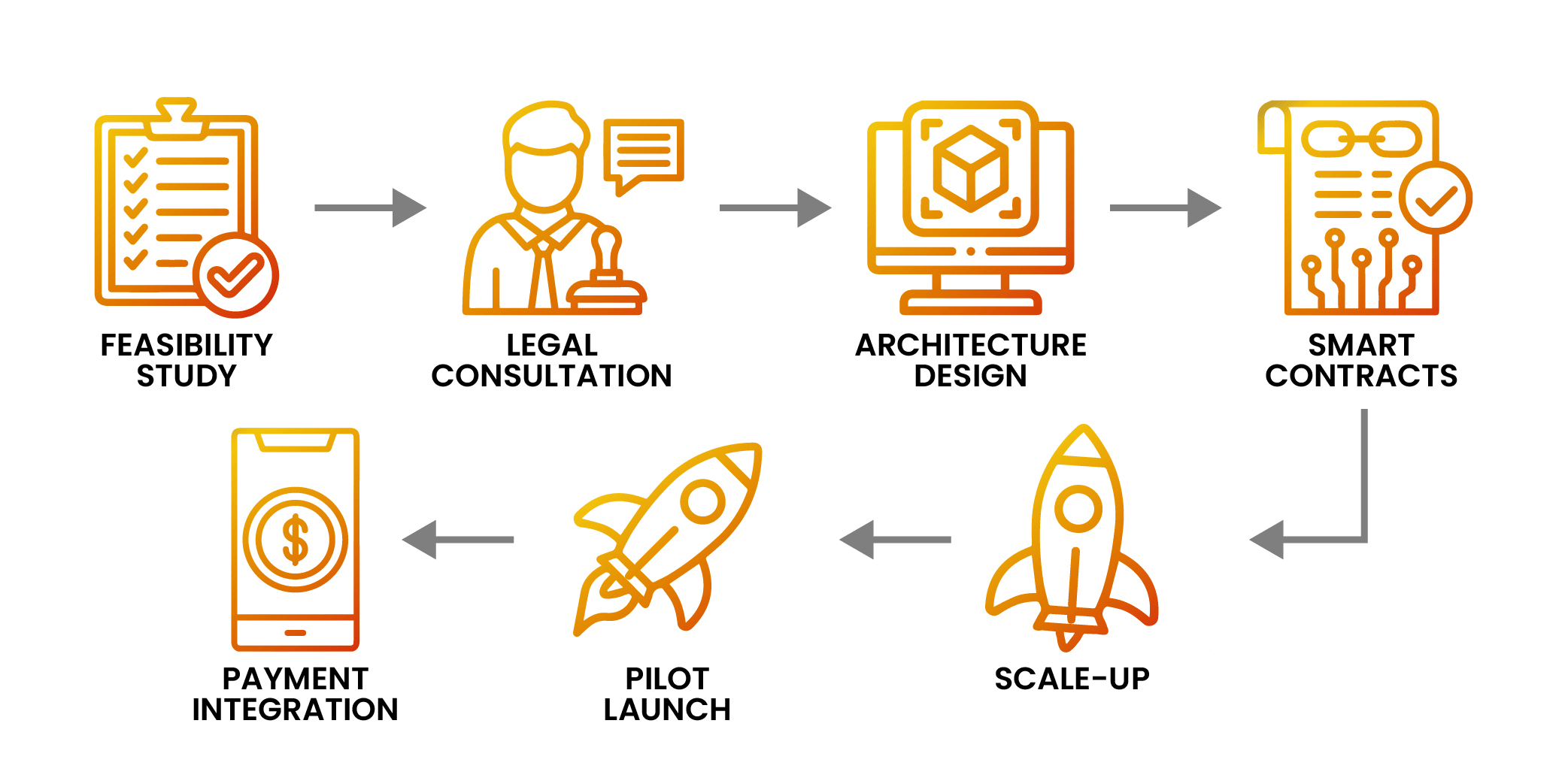

Developing a custom real estate tokenization platform in Saudi Arabia is not a simple checklist exercise. It’s a phased process that combines legal preparation, technical execution, and regulatory engagement. Each step requires attention to detail, collaboration with multiple stakeholders, and a clear vision for scalability. Here’s how businesses usually approach it:

The journey begins with understanding what assets can and should be tokenized. Companies need to analyze the type of real estate, such as commercial, residential, or mixed-use, and determine the investor appetite. Parallel to this, legal teams must review property laws, securities regulations, and CMA guidelines to assess compliance obligations. In Saudi Arabia, where financial regulations are evolving, early consultation with legal advisors and regulators is essential to avoid costly delays later.

Once feasibility is established, the next step is to design the system. The architecture must strike a balance between user experience and strict compliance. This means defining modules for property token issuance, KYC/AML verification, custodial wallet integration, and investor management. At this stage, developers also consider blockchain choices, such as Ethereum for global reach, Polygon for lower fees, or local blockchain solutions that may gain regulatory preference. The architecture should not only enable token issuance but also prepare for secondary trading and liquidity.

Smart contracts form the foundation of tokenization. They encode investor rights, revenue distribution, and transfer restrictions directly on the blockchain. For example, a contract could automate quarterly rent distribution to token holders without manual intervention. In Saudi Arabia, these contracts must undergo thorough testing to ensure compliance with CMA regulations, prevent loopholes, and protect investors. Independent audits by blockchain security firms are often recommended before deployment.

Tokenization platforms are not useful if investors cannot easily transfer money. Integration with Saudi banks ensures smooth transactions in Saudi Riyal, while connections with global payment systems allow international investors to participate. This step may also include support for stablecoins, enabling faster settlement and cross-border transactions. By offering multiple funding options, platforms increase inclusivity and broaden their investor base.

A platform’s success depends heavily on how intuitive it feels for users. Investor onboarding should be simple but compliant. Automated KYC/AML checks, guided registration flows, and multilingual support can make the difference between investor trust and drop-offs. Dashboards showing ownership percentages, transaction history, and asset performance are equally critical. In Saudi Arabia, where both institutional and retail investors will engage, the design must appeal to professionals while remaining accessible to first-time users.

Saudi Arabia’s fintech sandbox, supported by SAMA and CMA, provides a safe environment to test innovative financial solutions. A pilot launch within this sandbox allows the platform to operate with real investors under regulatory supervision. This phase is crucial for validating assumptions, testing user engagement, and refining compliance processes before scaling commercially. It also demonstrates credibility to regulators, investors, and partners.

After a successful pilot, the platform can expand its offerings. This includes tokenizing additional property types, integrating secondary market trading, and building liquidity pools to encourage active trading. Continuous monitoring of regulatory changes is vital. Saudi Arabia is still shaping its stance on tokenized securities, so platforms must be flexible enough to adapt quickly to these developments. Establishing partnerships with custodians, broker-dealers, and international investors will further strengthen the ecosystem.

Building a real estate tokenization platform in Saudi Arabia brings immense potential, but it also introduces a set of challenges that cannot be ignored. For businesses, investors, and regulators, acknowledging these issues early is the most effective way to establish long-term trust and stability.

Saudi Arabia is still shaping its legal framework around digital assets and tokenized securities. While the CMA and SAMA are actively providing sandbox environments and pilot programs, regulations can shift quickly. Businesses that invest significant resources in developing real estate tokenization platforms in Saudi Arabia must remain flexible, updating their compliance models as new regulations emerge.

Tokenized assets are still relatively new in the region. Many investors, particularly retail investors, may be unfamiliar with blockchain concepts or skeptical about their security. Clear education, transparent reporting, and user-friendly platforms are critical to overcoming hesitation.

The blockchain foundation of a custom real estate tokenization platform in Saudi Arabia provides transparency, but it also attracts cyber threats. Hacks, data leaks, and flaws in smart contracts can instantly damage credibility. Regular security audits, penetration testing, and third-party code reviews are non-negotiable.

While tokenization creates the potential for fractional ownership and trading, liquidity does not automatically appear. Platforms need to carefully design mechanisms for secondary trading, market-making, and investor exit strategies. Without a healthy marketplace, tokenized real estate could remain illiquid, undermining one of its strongest value propositions.

One of the major benefits of tokenization is the ability to attract foreign investors. However, this introduces challenges around international laws, currency exchange, taxation, and settlement processes. Ensuring smooth participation from both Saudi and overseas investors requires additional infrastructure and legal clarity.

Looking ahead, the opportunities are vast.

It’s not just about technology. It’s about rethinking property investment for a new generation of investors who expect digital-first solutions.

Real estate tokenization is reshaping how investors engage with property markets, and Saudi Arabia is emerging as one of the most promising destinations for this innovation. With Vision 2030 driving digital adoption, a clear regulatory push from SAMA and CMA, and growing investor interest, the foundation for real estate tokenization in Saudi Arabia is stronger than ever. Building a compliant, secure, and scalable platform requires not only technical precision but also a deep understanding of local regulations and investor behavior.

At Webmob Software Solutions, we stand as one of the top partners for real estate tokenization platform development in Saudi Arabia. Our expertise lies in creating secure, compliant, and future-ready platforms that address the needs of both businesses and investors. Whether you need a custom real estate tokenization platform in Saudi Arabia or seek guidance on building a robust tokenization platform for real estate in Saudi Arabia, our team delivers solutions designed to inspire confidence and foster long-term growth.

Looking to take the next step? Let’s turn your vision into a reality. Get in touch with our experts today and explore how our expert-driven approach to Real Estate Tokenization Platform Development can power your success.

Copyright © 2026 Webmob Software Solutions