January 19, 2026

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Real estate tokenization can look straightforward at first. You choose a property or a portfolio, create tokens that represent defined rights, and let investors subscribe through an online flow. But the reality is more demanding.

A production tokenization program needs identity checks, transfer controls, reporting, admin approvals, security controls, and a clear plan for how the platform will run after issuance.

That is why picking the right real estate tokenization development company is both a business decision and a technical one. You are selecting a partner to build a working system, not just a demo.

If you plan to hire blockchain developers for real estate, this guide will help you evaluate vendors based on delivery maturity, operational readiness, and risk control.

Many vendor conversations go wrong because the buyer starts with technology choices. A stronger approach is to define the outcome first, then work backward into requirements. Clear outcome descriptions also make vendor comparisons fair.

Start with three definitions:

When a vendor skips these questions, the project often turns into a collection of features that fail to work together.

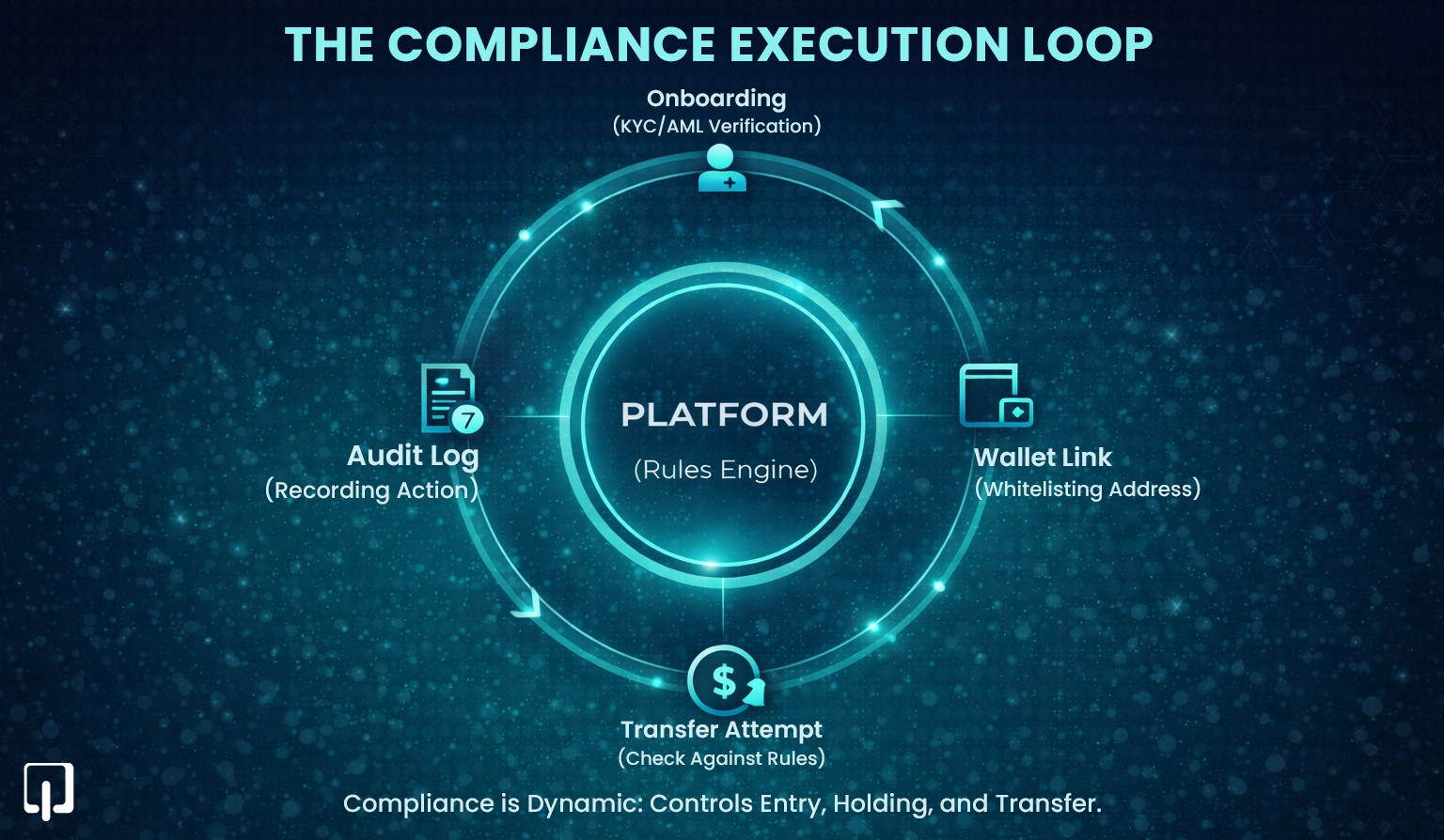

In real estate tokenization, compliance shapes onboarding, transfer logic, admin permissions, and audit trails. A vendor should build a product that supports your compliance plan and can work alongside counsel, even without providing legal advice directly.

When you speak with a blockchain software agency for RWA, ask them to explain how the platform enforces who can invest and who can hold tokens.

A mature team will describe the compliance layer in practical terms, such as how:

Also ask where sensitive onboarding data is stored and how it is protected. A production system needs strict access control and clear retention policies.

Tokenization extends beyond smart contracts. Real estate has ongoing operations that must be reflected in the platform. Distributions, updates to investor records, reporting, and support requests continue long after issuance.

This is where many buyers underestimate scope. A single real estate smart contract developer can write contract code, but that rarely suffices to run a tokenization program. You usually need a team that can build the portal, backend services, admin tools, and the supporting infrastructure.

Ask the vendor how they handle real estate-driven workflows, such as:

You need them to show they can translate operational requirements into screens, data models, and safe workflows, not just claim “industry expertise.”

Architecture becomes important as soon as you add real rules. The key is whether the platform is designed to be safe to operate and easy to maintain.

A strong real estate tokenization development company should be able to explain, in plain language, what sits where and why. Most production systems keep investor profiles, documents, and verification records in secure backend systems, while keeping ownership records and transfer enforcement in places where it can be verified and audited.

Ask for clarity on:

Vendors that struggle to answer these questions clearly often build systems that are hard to support.

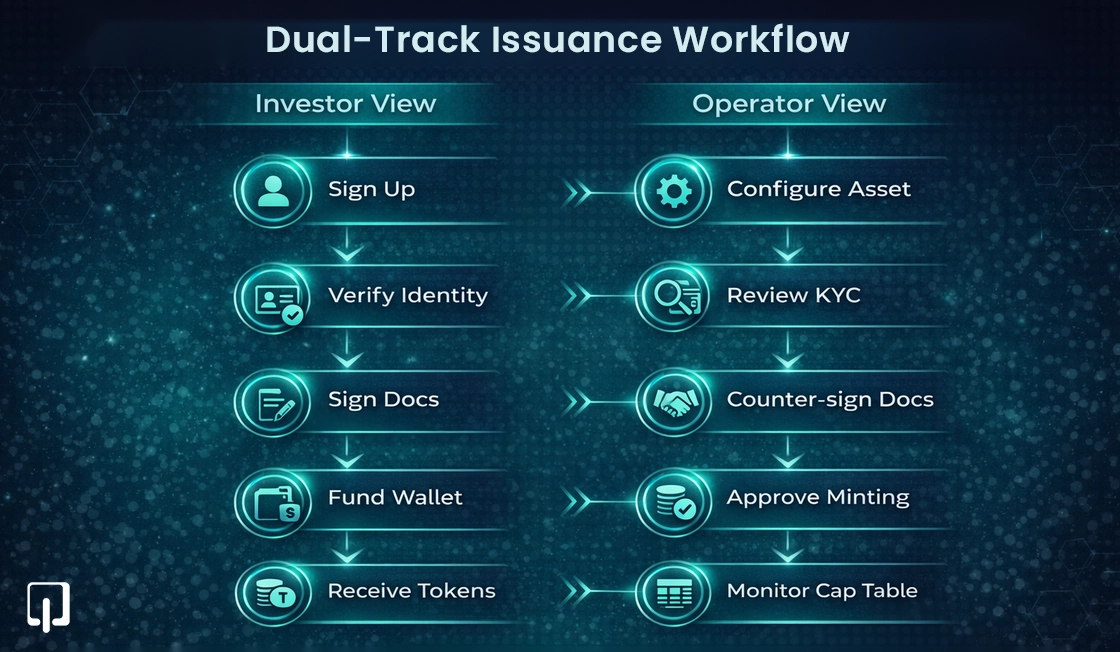

Issuance is not one action. It is a sequence of steps that must work for investors and internal operators. A platform that feels unclear or error-prone during issuance will create support issues immediately and reduce investor confidence.

Ask the vendor to describe the issuance flow end to end, then ask them to show what they would build for both investors and operators.

For the investor side, you should expect account setup, verification steps, document acceptance, subscription actions, and a clear status view. Investors should be able to see holdings and transaction history in a way that matches your program rules.

For the operator side, you should expect admin tools that include approval queues, allowlist management, issuance controls, and an audit log of sensitive actions. Operators should not be forced to rely on manual scripts or spreadsheets for core tasks.

If you are deciding whether to outsource real estate tokenization development, this section often separates mature teams from demo-first teams.

Some tokenization programs can launch without secondary transfers on day one. Still, many programs want a credible path to controlled transfers later. If the platform is not designed for it early, adding it later can force contract changes and workflow redesigns.

Discuss secondary readiness in practical terms. Ask how verified holders are maintained over time, how transfer rules are enforced and logged, what happens when an investor becomes ineligible, and how transfers work between verified parties under restrictions.

Be cautious with vendors that describe secondary liquidity as a quick outcome. Technology is only one part. You need rule enforcement, auditability, and a controlled process that matches your program constraints.

Security reviews often focus on contracts, but tokenization risk can come from many areas. Admin accounts can be compromised, keys can be mishandled, permissions can be too broad, logs can be missing, and monitoring can be absent.

When you hire blockchain developers for real estate, assess security across the full stack. Ask for their smart contract audit approach, review process, and audit preparation. Ask how they manage privileged actions such as issuance approvals, allowlist updates, and upgrades. Ask what access controls exist in the admin portal, and what monitoring and escalation processes exist after launch.

A tokenization program continues into operations after issuance. That includes distributions, reporting, investor support, routine updates, and periodic audits. If the vendor’s plan stops at launch, you will take on more operational risk than you expect.

Ask what the vendor will provide after launch, in writing, including:

A mature real estate tokenization development company will treat these as core delivery components.

Marketing pages and portfolios are not enough. You need proof that the team has delivered systems that work end to end and can be operated after launch.

Request tokenization platform development case studies that include the onboarding flow, transfer controls, admin tooling, reporting, security review steps, and post-launch support approach. If client names must remain confidential, ask for anonymized examples, redacted screenshots, or a guided walkthrough of a similar delivery.

Good case studies show a repeatable approach to permissions, audit logs, admin tooling, and change control. (See examples like Real World Asset Tokenization Platform or Decentralized Asset Tokenization Platform.

Some buyers prefer USA based real estate blockchain developers for time zone overlap, procurement reasons, or easier coordination. Others prefer global teams for cost or delivery speed. Either approach can work, but only with a strong delivery process.

If you plan to outsource real estate tokenization development, protect the project with clear controls: milestone-based delivery with demos and acceptance criteria, required documentation and admin runbooks, defined access policies for repositories and environments, and staging and production practices that are written and followed.

Location can help communication, but process is what prevents drift.

A good vendor interview is structured. You want answers that show how the product behaves and how the team works.

Ask:

When proposals look similar, use a scorecard to keep decision-making grounded.

Score each vendor across:

This also helps you decide whether you need a full real estate tokenization development company or a smaller engagement with a real estate smart contract developer.

According to McKinsey, tokenized market capitalization could reach $2 trillion by 2030, but success depends heavily on the robustness of the underlying infrastructure. Furthermore, as highlighted by the SEC, ensuring cybersecurity in digital asset infrastructure is paramount for regulatory approval

Choosing a real estate tokenization development company is about selecting a partner that can build a complete platform and run it responsibly after it goes live. Tokens are part of the solution, but the system around the tokens is what makes the program workable.

If your goal is to hire blockchain developers for real estate, focus on controlled onboarding, enforced transfer rules, strong admin tools, reporting support, and a clear plan for maintenance after launch.

If you need to outsource real estate tokenization development, protect the project with clear milestones, security standards, and a defined post-launch support plan.

Copyright © 2026 Webmob Software Solutions